TECHOIL RACK

AN INDUSTRY-SPECIALISED RACK MARKETING AND DISPATCH SYSTEM FOR FUEL MARKETERS

Accelerate your business with an integrated solution

Supporting in Every Step of Fuel Wholesale and Distribution

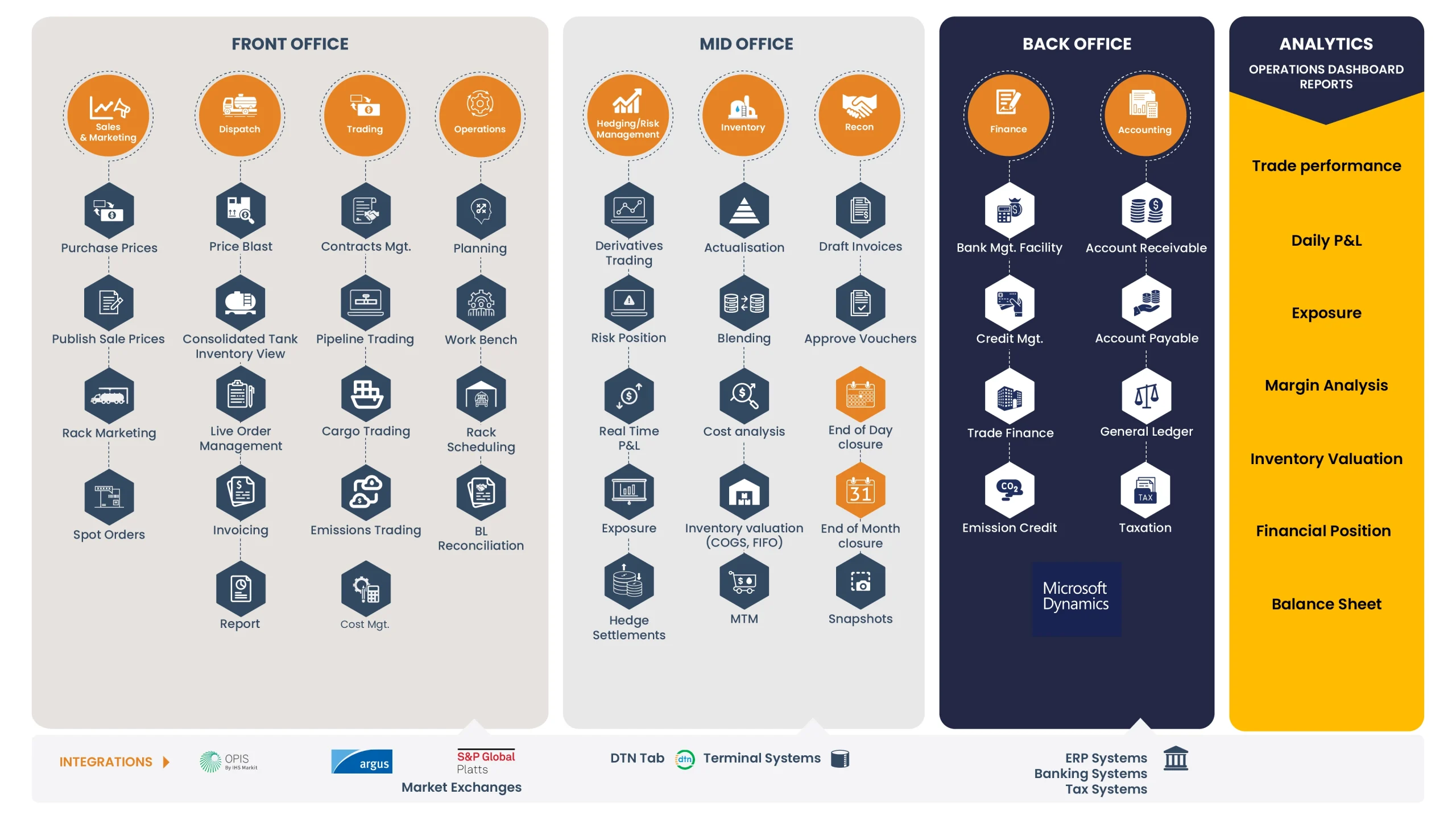

Techoil Rack is a dedicated cloud-based refined fuels wholesale supply and logistics system for fuel marketers. With a suite of integrated solutions including ETRM, ERP, Bestbuy & Dispatch, Taxation, and powerful analytics, this one-of-a-kind system seamlessly runs the entire business. With Techoil Rack, you can

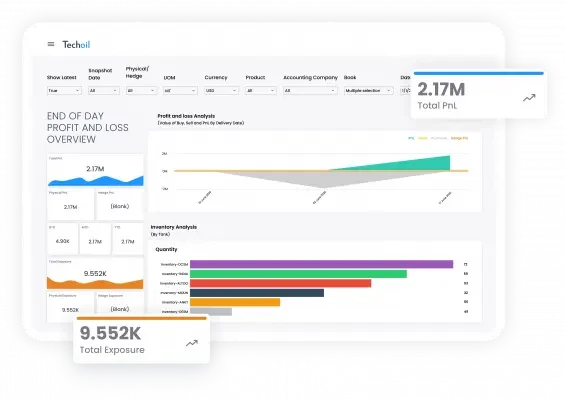

Access live PnL and exposure anytime, anywhere

Get accurate and reliable dispatch, billing, and tax information

Utilise advanced analytics and reporting for quick decision-making

Techoil Rack automates and easily manages various functionalities using a modern, integrated workflow. This translates to seamless operations, reduced errors, and effective utilization of time and resources!

Wholesale - Every Minute and Penny Counts

We understand that business can get tough when it depends heavily on cash flow with transactions involving short-term credit. With no control over price volatility and operational complexity, there is a fine line with adequate cash flow, including payment of state taxes and profit margins. The key to financial flexibility lies in optimising inventory as well as payable and receivable accounts.

Inatech’s Techoil Rack helps you with better control and management of working capital including

- What is your expected cash flow this week?

- How can you speed up invoicing and collection?

- What is your real-time PnL?

We will help you find these right answers and many more without the hassle of manual, mundane tasks!

Boost Cash Flow

If you are a fuel marketer, your focus would be to effectively handle hundreds of invoices. Techoil Rack ETRM helps you simplify this process with its invoice automation functionality. It means you receive all your invoices including bill of ladings (BOL) electronically, straight into the ERP.

Equipped with a robust tax module, it also optimises your supply chain, trading, inventory, and spot orders. Most importantly, Techoil Rack allows integration with OPIS and DTN suppliers feed, and enables terminal movement reporting, so you can be one step ahead.

Want to make decisions on real-time inventory levels instead of just estimations?

Want to know how you can adopt Techoil Rack to maximise margins?

What Makes Techoil Rack Stand Out

A specialised solution developed just for fuel marketers

Complete front, mid, and back-office automation and support

True cloud-based solution with NO recurring implementation cost

Best-in-class tools for advanced risk analytics, real-time position, risk reduction, margin optimisation, hedge effectiveness, stress testing and more

Seamless integration with external systems and data feeds for smooth operations

Robust customer service and support based on the priority of support requests

A Proven Solution for Your Entire Business

Our solution is failure-proof and requires zero intervention from your side whilst delivering the desired output.

Let us dive deeper to know how Techoil Rack is helping businesses achieve accelerated growth.

Visibility & Control

Gain real-time views on PnLs, inventory position and pricing. Moreover, gain a consolidated view of your business, as well as credit line visibility across accounts and counterparties. Additionally, reconcile trade in real-time to manage market volatility.

Rack marketing

Automate posting to OPIS of wholesale terminal prices of petroleum products at your and third-party operated terminals. Gain an easy comparison with OPIS benchmark prices to fix the final price as a differential to the market price. Moreover, automate the publishing of rack product prices to your customers' mailing lists or via DTN.

Inventory management

Manage inventory effectively through various costing methodologies such as Moving Average and FIFO (first-in, first-out). Moreover, capture spot transactions along with spot and contract rack orders, and practice flexible pricing with Techoil Rack.

Credit instruments trading

Achieve your decarbonisation goals with an extensive solution for credit instruments trading worldwide including

~ USA: RIN, LCFS, Cap &Trade

~ EU: ETS-FAME & UCOME

~ UK: RTFC

Risk management

Access real-time position management and know about advanced risks. Ensure regulatory compliance and minimise risk with in-built checkpoints and best practices. Utilise advanced analytical tools including what-if scenarios, portfolio analysis, and value at risk (VaR) models to hedge against downside P&L risk and protect profits.

Contract management

Manage single and multi-site end customers and gain visibility of daily lifting from purchase contracts with respect to the monthly lifting constraints. Plus, get detailed reporting on the remaining balance.

Bestbuy and Dispatch

Optimize costs and your working capital by buying fuel at the best price at the right time. Also, reduce phone calls with real-time online order and delivery status. You can now improve fuel delivery speed and ensure driver accountability and performance, warrant quick schedule deliveries with one click drag-and-drop dispatch, eliminate paperwork with electronic BOL's and delivery tickets, as well as get paid faster by invoicing within five minutes of delivering fuel.

What Our Customers Are Saying

Expedite your decision-making process to overcome market volatility with Techoil Rack

Press Release

INATECH GROWS AND SEEKS TO DIVERSIFY VIA PRODUCT INVESTMENT AND ALLIANCES

Inatech grew at around 25% in 2021 yet its CEO, Jean Hervé Jenn, described the year as ‘disappointing” by comparison to 2020 when I spoke with him recently.

ATLAS OIL TURNS TO INATECH’S TECHOIL TO SUPPORT ITS GROWTH STRATEGY

Atlas Oil Company, which is part of Simon Group Holdings and a leading nationwide fuel distribution and supply management company in the US

MITSUBISHI OIL TRADING UNIT PETRO-DIAMOND INC. MANDATES INATECH FOR DIGITIZATION OF US GASOLINE SUPPLY CHAIN

Petro-Diamond Inc., the oil-trading firm owned by Mitsubishi Corp.

Frequently Asked Questions

Energy Trading and Risk Management or ETRM software is primarily a category of software applications, architectures, and tools that help in supporting the business processes in commodity trading in the energy market. Used by oil traders, suppliers, distributors and wholesalers, ETRMs help companies assess market information to make data-driven decisions and maximise margins.

Many oil traders, suppliers, distributors and wholesalers still run their commodity trading businesses using manual processes, spreadsheets or outdated legacy systems. ETRM software enables operators to automate these outdated processes. This saves money and improves the efficiency of operations by streamlining trading, hedging, credit, cash flow, operations and inventory.

ETRM software also assists in managing risk and operating complex integrated supply chains for energy commodities. It handles complex interfaces effortlessly manages all front, middle and back-office needs, making it a cost-effective option for oil trading companies.

ETRM stands for Energy Tradeing and Risk Management and CTRM stands for Commodity Trading and Risk Management. These terms are used to describe a set of software that is utilised in commodity trading and risk management. ETRM is actually a subset of CTRM software.

ETRM solutions include many functionalities to address the key aspects of energy or commodity trading and risk management activities such as

- Trade and operations to cover everything from energy trading, contract management and operations to credit control and delivery.

- Hedging and risk management so you can hedge, monitor, forecast and report.

- Inventory management and reconciliation for a complete view of your inventory right across the supply chain.

- Contract management of single or multi-site end customers

- Rack marketing for automated posting to PLATTS of wholesale terminal prices.

- Financial accounting to enable planning, control, compliance and auditing.

- Reporting to give you a complete view of your business performance).

- Integration to make sure you can integrate with third-party applications

By implementing ETRM software companies can

- Manage market, operational, credit and counterparty risk more effectively.

- Control operational complexity and directly impact profitability.

- Access a consolidated view of the business. This simplifies informed decision making.

- Improve profitability through trade economics, accurate pricing formulas and MTM.

- Save time so you can focus on your business by streamlining operations to drive greater efficiencies throughout your business workflow.

- Reconcile trades in real-time.

- Have a solution that works across everything from trading to invoicing.

- Drastically reduce errors from manual or double entry through automation.

Yes! It provides and integrates the company’s front, middle and back-office operations. It also provides a scalable platform for effective risk management and increases efficiency within the company’s oil trading business.

Our strong and experienced project team can remotely and seamlessly implement true cloud-based ETRM within two weeks.

Yes, it has a natively integrated ERP that makes our ETRM an end-to-end solution! This feature gives you control over real-time position management and intra-day profit and loss statements.