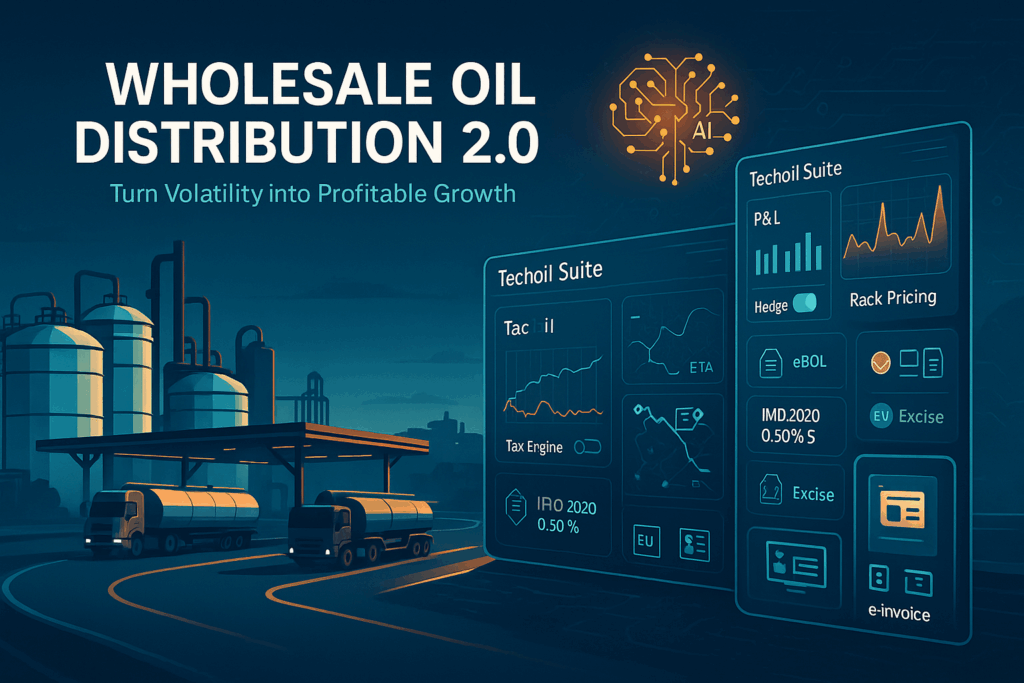

Wholesale Oil Distribution 2.0: How Inatech’s Techoil Suite Turns Price Volatility into Profitable Growth

1. What Does a Wholesale Oil Distributor Do?

Wholesale distributors purchase refined products (gasoline, diesel, marine fuels, heating oil, bio-blends) in bulk from refiners or terminals and resell them to retailers, fleets, shipping firms, and industry. Key functions include:

- Bulk purchasing & hedging to lock margin.

- Terminal & rack management for just-in-time liftings.

- Price-setting across rack, contract, and spot deals.

- Dispatch & last-mile delivery to stations, mines, farms, or vessels.

- Regulatory reporting—tax, excise, and sulfur compliance.

With roughly 8,000 U.S. businesses competing in the space, differentiation hinges on service levels, price intelligence, and digital convenience.

2. Market Landscape & 2025 Trends

2.1 Growing Volatility

Capital-disciplined producers and geopolitical disruptions keep supply tight, amplifying price swings . That volatility bleeds directly into rack margins.

2.2 Digital & AI Adoption

Emerging AI tools are increasingly being used in areas such as demand forecasting, route optimization, and dynamic pricing—capabilities many distributors view as critical for staying competitive.

2.3 Sustainability & Compliance

IMO 2020 slashed bunker-fuel sulfur to 0.50 % m/m outside the Emission Control Areas, forcing marine-fuel distributors to track blends and document emissions. Parallel pressure mounts for lifecycle carbon reporting across the oil supply chain .

3. Pain Points Keeping Distributors Awake

|

Challenge |

Why It Hurts |

Traditional Response |

Digital Response |

|

Price spikes & basis risk |

Shrinks or flips rack margins in hours |

Manual hedging in spreadsheets |

Real-time ETRM with & rule-based hedge triggers |

|

Siloed systems |

Trading, tax, dispatch, and finance rarely share data |

Re-keying, errors, slow close |

Unified cloud platform with single data model |

|

Regulatory complexity |

Federal & state excise, LMM, IMO 2020, EU ETS |

Paper filings, high audit risk |

Automated tax engine & compliance dashboards |

|

Inventory mis-allocation |

Wrong product at rack or vessel berth |

Phone calls & best-guess trucking |

AI-powered demand forecasting & dispatch optimizer |

|

Customer churn |

Retailers expect portal visibility & on-time delivery |

Price-only competition |

Capabilities such as self-service, shipment visibility, and invoice automation are often cited as priorities in distribution. |

4. The Digital Imperative: Why ETRM + Fuel Management Matter

Modern ETRM systems automate deal capture, risk analysis, and P&L in milliseconds . Layered with dispatch and rack modules, distributors gain:

- Live P&L & VaR dashboards—no more end-of-day surprises.

- Automated tax & excise calculations—reduces penalties and speeds close .

- Mobile eBOL capture & e-invoicing—cuts days-sales-outstanding.

5. How Inatech Accelerates Wholesale Oil Distribution

5.1 Unified Trading-to-Dispatch Platform

Techoil Rack combines ETRM, ERP, BestBuy pricing, and Dispatch in one cloud suite , eliminating data silos and manual re-entry.

5.2 Compliance by Design

Tax automation, fuel tracking, and configurable audit trails reduce regulatory risk under IMO 2020, EU ETS, and state excise schemes .

5.3 Case in Point: TechOil Dispatch

A distributor adopting TechOil Dispatch slashed manual order-entry time by 80 % and gained real-time ETA tracking for every truck.

6. Best-Practice Playbook for Distributors

- Map your data flow from deal capture to cash, identifying duplicate entries.

- Benchmark risk tolerance—set hedge ratios and VaR limits inside an ETRM.

- Automate tax and compliance workflows before sulfur-cap or carbon rules bite.

- Deploy predictive dispatch to align truck routes, customer tank levels, and rack pricing.

- Offer self-service portals so retailers and fleets can track loads, invoices, and contract positions 24/7.

- Measure ROI monthly—target a six-month payback via reduced working capital, lower penalties, and higher customer retention.

7. Conclusion

Wholesale oil distribution is no longer just about moving molecules; it is about moving data faster than the market. Distributors that digitize now will monetize volatility, delight customers, and comply with emerging green mandates—while stragglers risk margin compression and lost share. Inatech’s cloud-native Techoil give operators the integrated trading, risk, and logistics backbone they need to thrive in 2025’s high-velocity fuel landscape.

Ready to future-proof your distribution business? Explore how Inatech can help.