INATECH RENEWABLE FUELS ETRM

A BESPOKE TRADING AND SUPPLY MANAGEMENT SYSTEM

Precisely Designed for the Rapidly Emerging Renewable Fuels Market

All-Inclusive Solution for Biofuels and Renewable Fuels Trading

Inatech renewable fuels ETRM is a dedicated cloud-based, real-time, end-to-end trading and supply management software for biofuel and renewable fuel traders. It is built on modern architecture and equipped with in-built ERP, and powerful analytics. With Inatech Renewable Fuels ETRM, you can

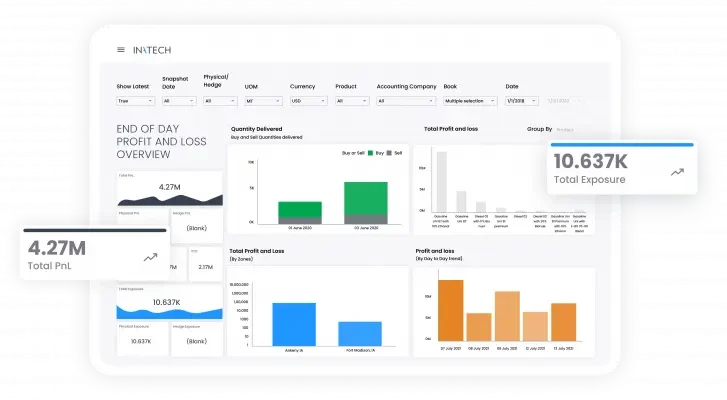

Access real-time P&L and personalised dashboard

Trade emissions credit products (RIN, LCFS and Cap &Trade)

Manage complex feedstock supply chain

Inatech Renewable Fuels ETRM automates and easily manages various functionalities using a modern, integrated workflow. This translates to seamless operations, reduced errors, and effective utilization of time and resources!

Biofuels Supply and Trading-Unique Challenges

With changing environmental regulations, the impetus is on renewable energy to reduce carbon emissions. We come with a deep understanding of biofuels wholesale and retail supply chain. We know that the trading and management of alternative fuels such as feedstock—vegetable oil, used cooking oil (UCO), as well as other products including gasoline, ethanol blends, fatty acid methyl ester (FAME) and hydrogenated vegetable oil (HVO), brings a unique set of bottlenecks. These may include evolving global emission regulations, sourcing of raw materials, hedging of biofuel products as well as logistics and storage of multiple types of feedstock and materials.

We have developed a specialised, failure-proof biofuels trading software to help you gain complete visibility and control over your business in real-time including

Top 3 questions that Inatech renewable fuels ETRM will help solve

- What is your daily physical exposure and PnL?

- What is your overall Inventory position

- How do you reconcile your bill of lading (BOL) report?

Inatech renewable fuels ETRM will help you find these answers and much more, eliminating the reliance on manually compiling data from multiple sources and departments.

Utilising Sustainable, Scalable Technology

Inatech renewable fuels ETRM helps you streamline trading including emissions credit instruments rading, hedging, credit, inventory, and cash flows. It ensures leaner operational management by handling different types of feedstocks and biofuel products, supply chains and cost structures across geographies.

Want to know how you can integrate inatech renewable fuels ETRM to make profitable decisions?

What Makes Our Solution Stand Out

A specialised solution for biofuel and renewable fuel traders

Manage various credit instruments trading schemes across geographies

True cloud-based solution with NO recurring implementation cost

Best-in-class tools for advanced risk analytics, real-time position, risk reduction, margin optimisation, hedge effectiveness, stress testing and more

Seamless integration with external systems and data feeds for smooth operations

Robust customer service support on utmost priority for every business process request

Industry-Specific Solution for Your Needs

Our solution requires zero intervention from the customer side whilst delivering the desired output. This is how Intaech renewable fuels ETRM is transforming businesses!

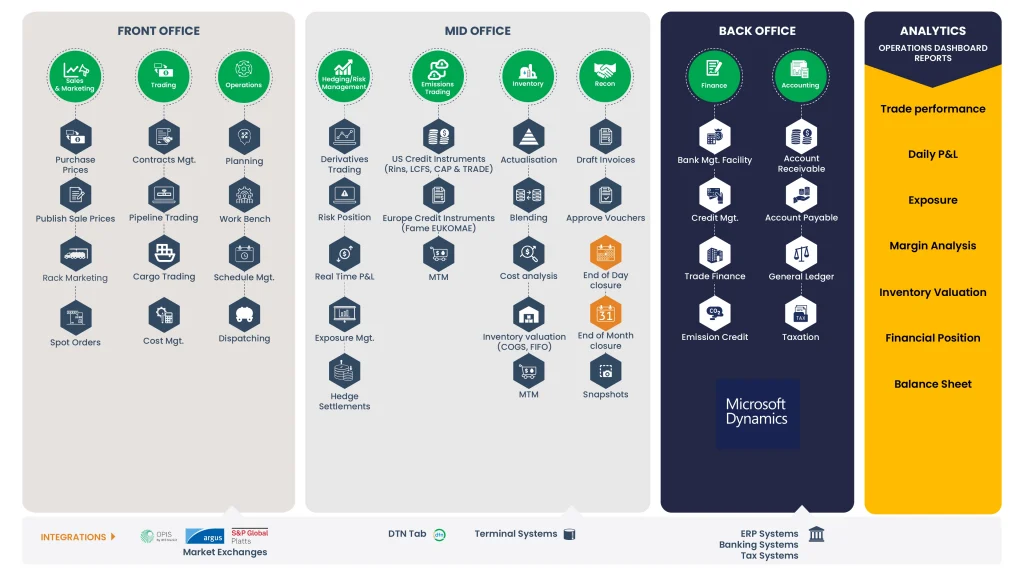

The ONLY complete front, mid and back-office solution

Process purchases and sales straight-through to invoicing. Inagreenl is in fact truly ERP agnostic—even if you want to retain your current ERP, it can integrate with any system available on the market.

One version of the truth

Get a consolidated view of your business, real-time position management, and intra-day profit and loss statements. Ensure a single data entry point and end-to-end process flow following easy integration with external data feeds and pricing systems. Moreover, gain complete visibility and control on physical and paper trade PnL with real-time trade reconciliation capabilities.

Inventory management

Manage inventory effectively through various costing methodologies such as weighted average, FIFO (first-in, first-out) and LIFO (last-in, first-out).

Emissions credit instruments trading

Achieve your decarbonisation goals with an extensive solution for credit instruments trading worldwide including

~ USA: RIN, LCFS, Cap &Trade

~ EU: UCOME, FAMEO & ETS

~ UK: RTFC

Physical operations planning & logistics

It can handle multiple modes of transportation including vessel, rail and road. Additionally, it offers complete support for physical and financial products.

Risk management

Access real-time position management and trade complex options. Utilise advanced analytical tools including what-if scenarios, portfolio analysis, and value at risk (VaR) models to hedge against downside P&L risk and protect profits.

What Our Customers Are Saying

So, why delay? Effectively manage risk and supply chain complexities with Inatech Renewable Fuels ETRM!

Press Release

OIL TRADER EMAD ENERGY CHOOSES INATECH’S TECHOIL TO INTEGRATE ITS WORLDWIDE OPERATIONS

Emad Energy has chosen Inatech’s Techoil oil commodity management solution to help it expand into new markets and scale up its operations.

INATECH GROWS AND SEEKS TO DIVERSIFY VIA PRODUCT INVESTMENT AND ALLIANCES

Inatech grew at around 25% in 2021 yet its CEO, Jean Hervé Jenn, described the year as ‘disappointing” by comparison to 2020 when I spoke with him recently.

ATLAS OIL TURNS TO INATECH’S TECHOIL TO SUPPORT ITS GROWTH STRATEGY

Atlas Oil Company, which is part of Simon Group Holdings and a leading nationwide fuel distribution and supply management company in the US

Frequently Asked Questions

Energy trading and risk management or ETRM software is primarily a category of software applications, architectures, and tools that help in supporting the business processes in commodity trading in the energy market. Used by oil traders, suppliers, distributors and wholesalers, ETRMs help companies assess market information to make data-driven decisions and maximise margins.