RENEWABLE FUELS AND CREDITS TRADING

Renewable Fuels and Credits Trading

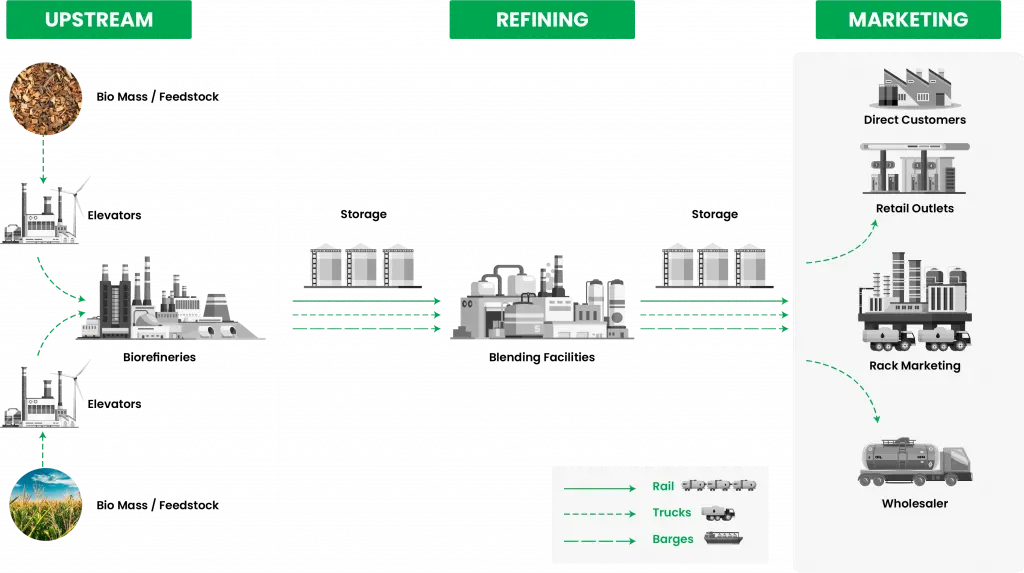

Renewable fuels including biofuels are being increasingly adopted to tackle climate change and meet the decarbonisation goals. However, trading and management of cleaner fuels come with unique challenges including sourcing of raw materials, hedging of biofuel products, as well as logistics and storage of different types of feedstock and materials.

This underlines the need for an ETRM that can help biofuel traders stay on top of these challenges and maximise margins.

Inatech Renewable Fuels ETRM is an industry-specialised trading and supply management system comprising ERP, advanced analytics, and emissions credits trading to handle varying requirements across geographies.

Functionalities

Inatech Renewable Fuels ETRM offers an end-to-end solution that caters to all your business needs.

Trading

Hedging

Credit instruments trading

Risk management

Inventory management

Financial accounting

Reconciliations

Find out more about Inatech Biofuel ETRM >>

What Our Customers Are Saying About Us

Gain Complete Visibility and Control Over Your Business, Discover Inatech Renewable Fuels ETRM

Blog

THE BENEFITS OF HEDGE MANAGEMENT USING ETRM SOFTWARE

Commodity prices and interest rates are often highly volatile. This can directly affect your cash flow and your margins.

Smart Trader Webcast: Biofuels 101 – Its production, how it’s traded and its future - Inatech

In our first episode, we’re exploring the impact from the massive volatility in oil prices with analysis from Patrick Hayes,

9 reasons to upgrade your outdated ETRM system today. - Inatech

To compete in today’s oil industry it’s all about reacting faster to changing market conditions. Managing and taking advantage of oil price volatility.